springfield mo sales tax on food

This includes state sales tax of 4225 the city sales tax of 2125 and the county sales tax rate of 175. 5 2019 the most recent renewal of the 18-cent Transportation Sales Tax was passed with a 20-year sunset.

Sales Tax Breakdown Springfield Details.

. While the missouri statewide sales tax rate on food is reduced to 1225 local tax rates still apply. While the missouri statewide sales tax rate on food is reduced to 1225 local tax rates still apply. There is no applicable special tax.

Posted by 2 days ago. Missouri Retail Sales Tax License. 18-cent Transportation Sales Tax 2021 - 2041 Approved by Springfield voters on Nov.

Higher sales tax than 61 of Missouri localities 15 lower than the maximum sales tax in MO The 81 sales tax rate in Springfield consists of 4225 Missouri state sales tax 175. The following list of programs and projects were identified and approved by voters for the first four years of the tax. What is food tax in springfield mo.

If your business activity involves operating a food establishment proof of a healthfood permit is required prior to issuing the license. The December 2020 total local sales tax rate was also 8100. While the Missouri statewide sales tax rate on food is reduced to 1225 local tax rates still apply.

Stanton MO Sales Tax Rate. The Springfield Missouri sales tax is 760 consisting of 423 Missouri state sales tax and 338 Springfield local sales taxesThe local sales tax consists of a 125 county sales tax and. What Is Food Tax In Springfield Mo.

The current total local sales tax rate in Springfield MO is 8100. The minimum combined 2022 sales tax rate for Springfield Missouri is. What is food tax in springfield mo.

The city sales tax rate of 2125 includes a 1-cent General Sales Tax 14-cent sales tax for capital improvements 18-cent Transportation Sales Tax and 34-cent Pension Sales Tax. In Springfield approximately 59 of revenue in the General. What is the sales tax on food in Springfield Missouri.

Lawmakers exempted food sales from the 3 general revenue tax because the purpose at the time was to reduce state revenue below constitutional limits. Sales tax state local sales tax on food. Created May 29 2008.

This is the total of state county and city sales tax rates. Counties and cities can charge an additional local sales tax of up to 5125 for a. The Missouri state sales tax rate is 423 and the average MO sales tax after local surtaxes is 781.

The SalesUse Tax Exemption Certificate must be given to the seller by the purchaser. The 81 sales tax rate in Springfield consists of 4225. What is the sales tax rate in Springfield Missouri.

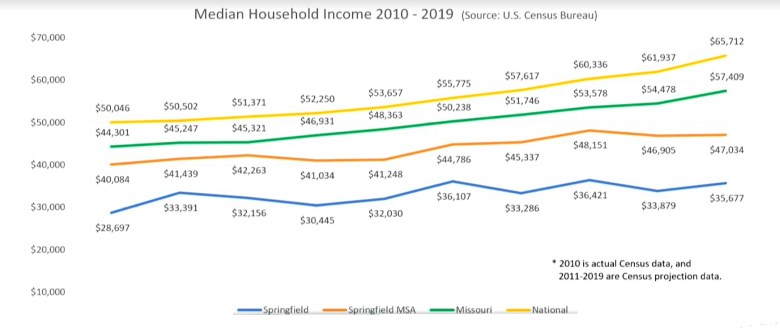

The springfield sales tax rate is. Review the sales tax benchmarks. The rate for food sales was reduced by 3 from 4225 to 1225.

The City heavily relies on sales tax revenues as its main source of revenue to fund vital services such as police and fire operations. The county sales tax rate is. Create an Account - Increase your productivity customize your experience and engage in information you care about.

The 81 sales tax rate in Springfield consists of 4225 Missouri state sales tax 175 Greene County sales tax and 2125 Springfield tax. The Springfield Missouri sales tax is 760 consisting of 423 Missouri state sales tax and 338 Springfield local sales taxesThe local sales tax consists of a 125 county sales tax. The current total local.

The county sales tax rate is. No SB727 creates a sales and use tax exemption for farm products sold at farmers markets.

Despite High Sales Tax Revenue Springfield Preps For Inflation Fueled Slowdown Springfield Daily Citizen

A Quick Guide To Save Money This Tax Holiday Weekend

2821 S Natural Bridge Dr Springfield Mo 65809 Realtor Com

Missouri Lawmakers Discuss Easing Tax On Groceries

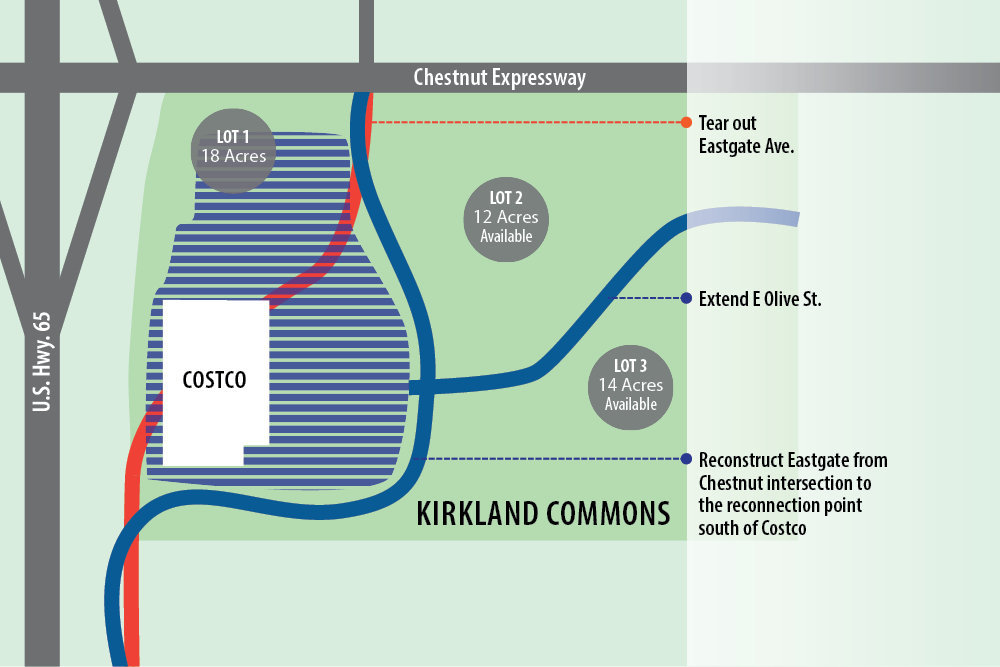

Council Passes Costco Deal Springfield Business Journal

Sales Taxes In The United States Wikipedia

Hardee S Home Springfield Missouri Menu Prices Restaurant Reviews Facebook

Businesses And Lawmakers Say Missouri Online Sales Tax Bill Could Help Level Playing Field

/cloudfront-us-east-1.images.arcpublishing.com/gray/KWUPCXIAZJGU3E4TBJBR5DW5IQ.PNG)

Missouri Lawmakers Discuss Easing Tax On Groceries

Is Food Taxable In Missouri Taxjar

Despite High Sales Tax Revenue Springfield Preps For Inflation Fueled Slowdown Springfield Daily Citizen

Illinois Sales Tax Calculator And Local Rates 2021 Wise

Www Expressfoods Net 417 766 4628 Home

Use Tax Web Page City Of Columbia Missouri

Missouri Bill Would End State Sales Tax On Food Groceries

Is Food Taxable In Missouri Taxjar

Www Expressfoods Net 417 766 4628 Home

Springfield Art Museum Announces 2 Million In Tax Credits And Names 2028 Campaign Chairs

/do0bihdskp9dy.cloudfront.net/10-13-2022/t_bb045f8adbda47a08396ffe93362bfc7_name_Screen_Shot_2022_10_13_at_10_09_41_AM.png)