does renters insurance cover water damage from water heater

A separate flood insurance policy will cover mold damage in most cases. A burst pipe or failed water heater is typically covered by a standard homeowners insurance policy as long as the damage is not caused by improper or insufficient maintenance.

Water Damage H2o And Your Home Insurance

Aurora meets the little Mermaid.

. So if your hot. Does your policy cover it or does theirs. Christina is the life of the party.

Homeowners insurance can also help cover your expenses if someone visiting your home is injured or if youre sued. These riders will cover the damage from. You can get flood insurance if you live outside a floodplain or in a low to moderate flood-risk area and at lower cost.

Your home insurance policy should cover any sudden and accidental water damage resulting from a plumbing failure such as a burst pipe or ruptured water heater. 1 However keep in mind your own flood insurance rates will vary depending on your coverage amounts and flood zone. Homeowners insurance may cover storm damage but it depends on the specific situation.

Another option would be to add an endorsement to your homeowners insurance policy to cover water damage from backed-up septic tanks or sump pump failure. Certain repairs to fix your homes foundation may be covered by your insurance policy. For all those saying insurance doesnt cover water damage its really up to the policy.

Allstate homeowners insurance helps protect your house and your family. This applies to other household appliances as well as plumbing heating systems. And unless youre in the 1 of US.

Get a home insurance quote find coverage options and more. You can buy flood insurance even if your. Your condo gets water damage from the condo above you.

Homeowners insurance may help cover damage resulting from power surges depending on what caused the surge and what was damaged. The dwelling coverage component in your homeowners insurance pays to rebuild or repair damage to your house and any attached structures like a porch or garage. You can get flood insurance from insurance agents in your area.

How homeowners insurance works. Talk about a fish out of water. Should be so before even buying it.

Property Coverage A - Dwelling. Is 62 according to our analysis of 2022 National Flood Insurance Program NFIP policy data. Home insurance doesnt cover flood damage including mold.

Homeowners insurance excludes coverage for mold if the damages are due to the following. I have had claims for sewer backup paid out 5k had buddy who had water damage in his kitchen and they had to rip out most of the floor and it was covered. Just like the Insurance Companys ad saysLIKE A GOOD NEIGHBORCHRISTINA IS THERE.

When it comes to floods and your home keep the number one in mind. When does homeowners insurance exclude coverage for mold. Water damage could cause enough damage that youd need to repair part of your homes structure replace destroyed property and possibly relocate from your house for a few nights.

Water damage from outside flooding and sewer backups are not covered but you can buy separate flood insurance or add water backup coverage as an endorsement to make sure youre fully protected. You need to read and understand it. A typical homeowners insurance policy comes with three types of coverage that may help pay to repair a broken window depending on what caused the break and whose window it is.

If you live in a special flood hazard areas like zones A AE or AO youll likely have higher flood. What do you do. From burst pipes to leaking plumbing learn what homeowners insurance may and may not help cover.

Learn more about coverage for home appliances. Pins needles and cover-ups. Sewing up loose ends.

For example if you have 300000 in dwelling coverage then that is the maximum amount your insurance will pay out for damage to your home. Covers your homes structure roof and built-in appliances or structures like your water heater and countertops. Most standard homeowners policies help cover water damage if the cause is sudden and accidental but there may be situations that your policy does not cover.

Waking up to a flood in your basement due to a faulty water heater is anything but pleasant especially after you realize your floor is damaged. Does my homeowners insurance cover water damage. Use our guide to find the best water leak detectors by comparing price integrations and sensors.

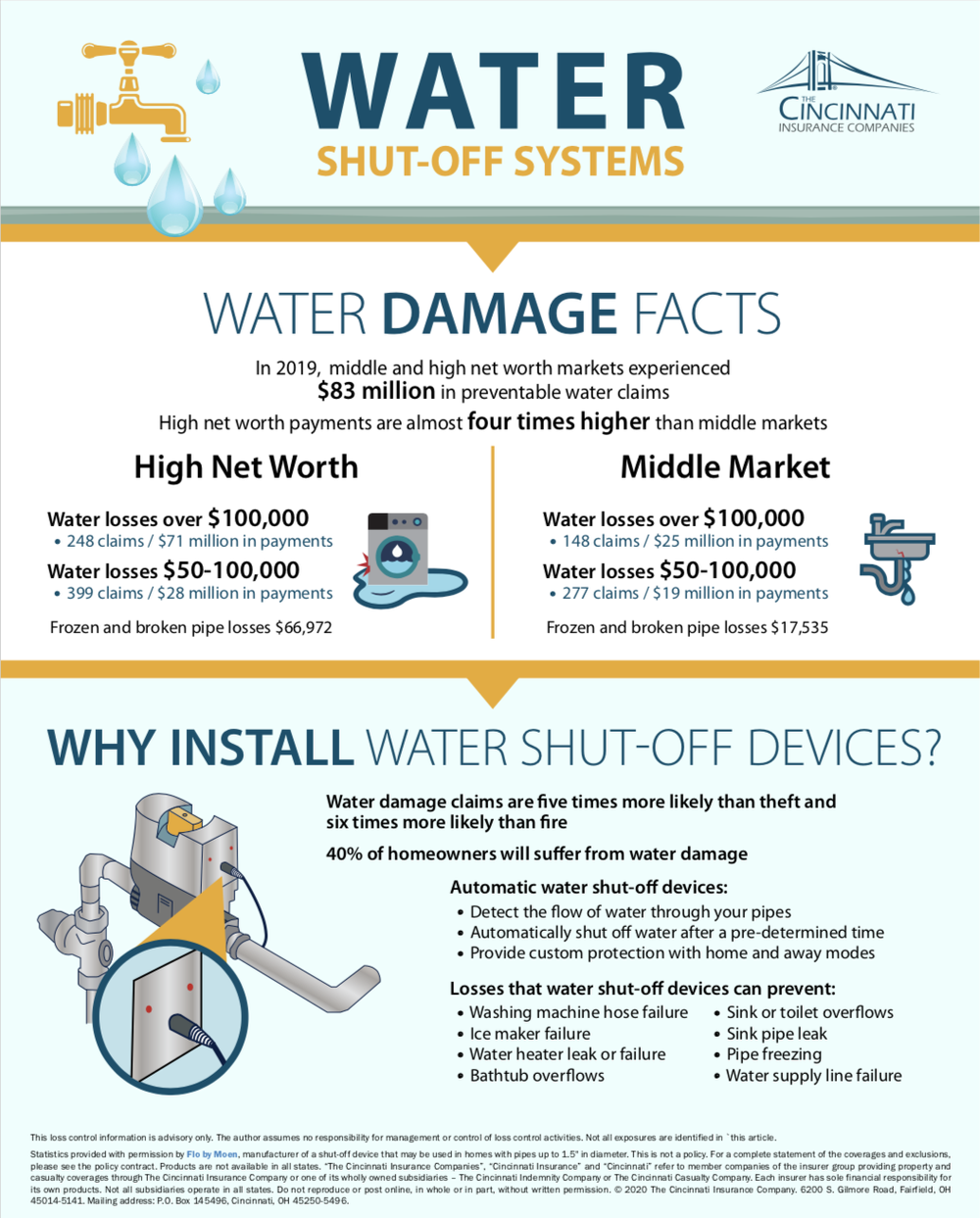

Only 1 inch of water can cause 25000 of damage to your home according to FEMA. 9 hours ago Burst pipes rain. If water backs up due to a broken pipe or.

You can get flood insurance if your property has been flooded before. The average monthly cost of flood insurance in the US. Even the band wants in.

In this scenario your standard homeowners insurance policy will cover the costs associated with the damage and an agent can help you start the. Unlike flood damage water damage is typically covered by renters insuranceFor instance if your washing machine suddenly breaks resulting in water damage to your apartment and the belongings inside your renters insurance policy will usually cover the costs. Just 1 inch of water can cause up to 25000 in damage to a home or apartment The Cost of Flooding and Prevention Most homeowners pay less than 400 per year for flood coverage in low- to.

Most homeowners insurance policies cover 16 common perils. Learn when you might and might not be covered for things like cracks leaks and other damage. Water damage from burst pipes and rain or snow are covered by most homeowners insurance companies.

Homeowners insurance may help cover home appliances in certain situations that are not related to age and maintenance. You can get flood insurance if you live in a floodplain or high flood-risk area. To receive coverage youll pay a premium each year to an insurance carrier and the insurer pays out if you need to file a claim.

Top picks include Zircon Govee and Resideo.

What You Need To Know About Renters Insurance And Water Damage Rhino Blog

Water Damage What Is Covered Leavitt Group News Publications

What Does Renters Insurance Cover In Your Apartment 2022

Types Of Water Damage Covered By Insurance In Illinois Trusted Choice

Does Renters Insurance Cover Water Damage Propertynest

Is Rental Insurance Worth It Everything You Should Know Irvine Co

Avoid A Homeowners Claim With Automatic Water Shut Off Devices Wallace Turner Insurance

Will Home Insurance Cover Water Damage Appliances Plumbing

Ksl Investigates What Water Damage Is Not Covered By Homeowners Insurance Ksl Com

What Does Renters Insurance Cover The Sacramento Bee

Does Renters Insurance Cover Water Damage The Simple Dollar

Does Renters Insurance Cover Water Damage

Does Home Insurance Cover A Hot Water Heater Replacement

Does Renters Insurance Cover Water Damage Propertynest

Does Homeowners Insurance Cover Water Damage Nerdwallet

Does Homeowners Insurance Cover Water Damage Stellar

Ysk That Renters Insurance Will Cover Water Damage If It Came From A Source Within Your Apartment But It Does Not Cover Water Damage From Floods For Those Living In Flood Prone